The Humbug of an Economic Recovery

From the depths of a deep pit, the ground appears to be a steep climb. It is this illusion that the mandarins of North Block, aided by pundits in the media, are banking on while claiming that the economy is on a “rebound”. The latest data on national Gross Domestic Product (GDP), for the second quarter of the current financial year (June-September 2021), which was released on November 30, is being touted as evidence that the economy is on the mend after being ravaged by the pandemic that has lasted a little over six quarters since April 2020.

Statistics, especially official economic statistics, need to be treated with skepticism. One of the problems that has confounded economists, analysts and commentators in the pandemic — but a problem that is not really new for anybody familiar with seasonality that is so characteristic of economic reality — pertains to what goes by the name of the “base effect” problem in statistics.

Simply put, when output — which is what GDP is — declines by a certain percentage during a time frame (in a quarter or a year), it requires a higher magnitude of increase to ensure that the level of output returns to its previous level. Or, to put it differently, if the Indian economy declined by 7.25% in 2020-21, it would take much more than 8.4% growth to reach its pre-pandemic output levels.

A few important caveats

But first, a few important caveats about reliability of the quarterly GDP numbers. For several reasons, economists, especially those with expertise and specialisation in macroeconomics, do not care too much for the quarterly numbers. Indeed, the release of quarterly numbers reflects a fetish of quarterly results, mirroring the practices of corporate entities who have their eyes glued to the stockmarkets.

India started reporting quarterly figures from the mid-1990s. Evidently, this reflects the growing importance of markets; like much else, this practice, too, perhaps is a child of the liberalisation era culture, even if its authenticity and its fidelity remains highly suspect among professional economists.

First, these are “initial” estimates, based on what are called high-frequency data points. Indeed, the GDP numbers released by the National Statistical Office has on its last page a list of 23 “main indicators”, which, presumably went into the computation of the GDP estimates. The economy is much more than these variables.

Second, these initial estimates will themselves undergo at least two rounds of revisions before they are declared “final”, by which time about two years would have elapsed. Who would pay attention to the second quarter results of 2021-22 two years later when the world’s attention has moved on? In fact, there is a perverse logic built into this; it is not uncommon for those in authority to reduce earlier numbers in order to show the current numbers in better light.

Third, a large part of the unorganised and small-scale sectors are simply bypassed in these estimates. This, despite the fact that it is precisely these segments that have been devastated in not only the ongoing pandemic but also the disastrous demonetisation of 2016 and the Goods and Services Tax regime that was implemented the following year. Despite these caveats, a closer look at the latest data released by the Narendra Modi government reveal an economy in deep trouble.

Overcoming the base-effect illusion

In order to escape the illusion of the base effect, it would make sense to compare levels of output — of all goods and services — which is what GDP actually seeks to measure. The fundamental objective of an assessment of claims of a recovery is to ask the question: has the level of output recovered to its pre-pandemic level? Or, another way of interrogating this claim is to ask: how far is India short of the output that would have been generated, had there been no pandemic? In order to evaluate these claims, let us consider the first half (H1) of the current financial year (April-September), instead of merely the three-month period ending September 30.

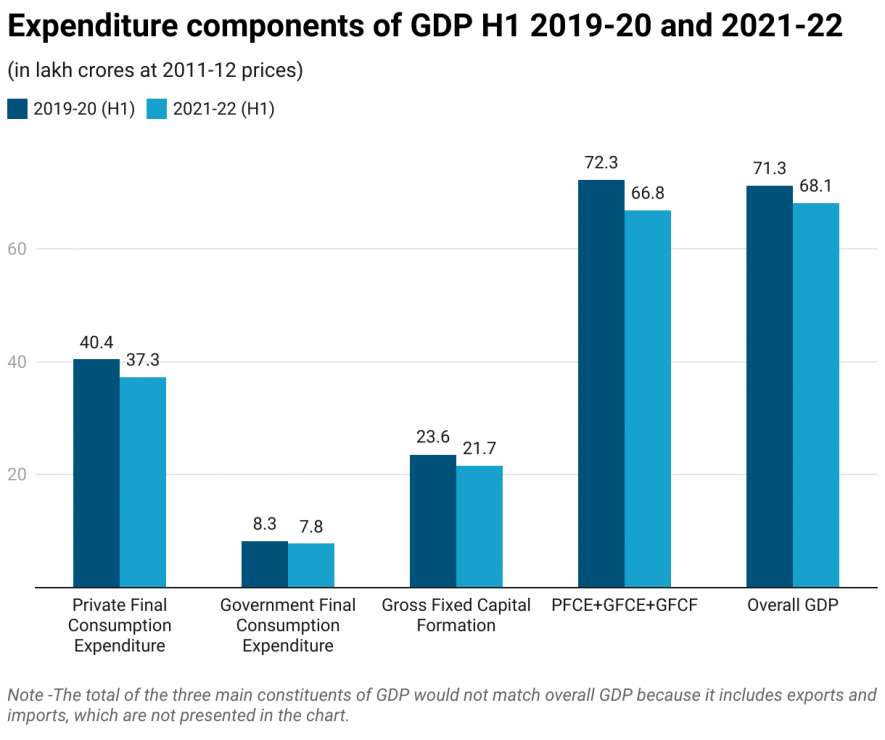

Data Source: Ministry of Statistics and Programme Implementation

There are three main constituents of India’s GDP when sliced in terms of the three main categories of expenditure. The first, and most important, accounting for almost 55% of overall GDP, is Private Final Consumption Expenditure (PFCE). This constitutes all private consumption in the economy, and, despite grave and widening inequalities, which have widened further in the pandemic, is a marker of the overall consumption demand in the economy.

The second slice of GDP comes from Government Final Consumption Expenditure (GFCE), which reflects not just expenditure by the government for its own functioning but also transfer payments that it makes for social security of other such programmes. Given the scale of the pandemic, and given that one would expect that a government that cares for its people’s welfare would have spent more by way of income support programmes in the pandemic, it would be logical to expect higher expenditure on this count.

The third, and very vital constituent of GDP, is Gross Fixed Capital Formation (GFCF), which is a marker of the investment in capital stock. These three constituents of GDP account for almost all of national GDP; net exports (after netting out imports) is a very small proportion of overall GDP. What do the latest data tell us a about these three components?

Miserable growth, misery all round

Here is what we get: overall GDP in H1 2021-22 was Rs 68.11 lakh crore, 4.4% lower than the level of output before the pandemic, in fiscal year 2019-20 (all prices are standardised at 2011-12 levels). But the three main slices of GDP fared much worse (see Chart 1). The level of consumption, indicated by PFCE, declined by 7.72. Government expenditure, reflected by GFCE, fell by 5.32%. Most important, investment in capital stock, which has the potential to propel economic activity via the multiplier effect, declined by more than 8%.

The Modi regime’s aggressive commitment to disinvestment means that it closes the option of using public undertakings to kickstart investment. Finance Minister Nirmala Sitharaman’s recent plea to industrialists that they undertake risks reflects the desperation of the government. Thus, the output levels of all three main constituents of national GDP were significantly lower in H1 2021-22 when compared to the pre-pandemic levels. To call this a recovery would be positively laughable if not for the grave misery these numbers convey.

In fact, the apparently more respectable decline of overall GDP — by a more modest 4.4% — is again the result of a statistical illusion. Indian exports registered a significant increase in the first half of the current year compared with 2019-20 — by almost 13%. But, given the fact that Indian exports are still heavily reliant on primary commodities — refined petroleum, diamonds, jewellery, minerals, etc. and even foodgrains — one suspects that the higher value of exports may be arising from the ongoing surge in international commodity prices.

In other words, the price effect, instead of the quantity effect, may be at play in creating the illusion of higher exports. Indeed, the fact that imports increased at a much slower pace — less than 5% since 2019-20 — is more an indication of the anaemic growth of Indian industry, which is known to have become more import-intensive. It would be logical to assume that imports would surge if or when a recovery in industrial activity gets underway, which would neutralise the positive contribution of exports to overall GDP.

The yawning output gap

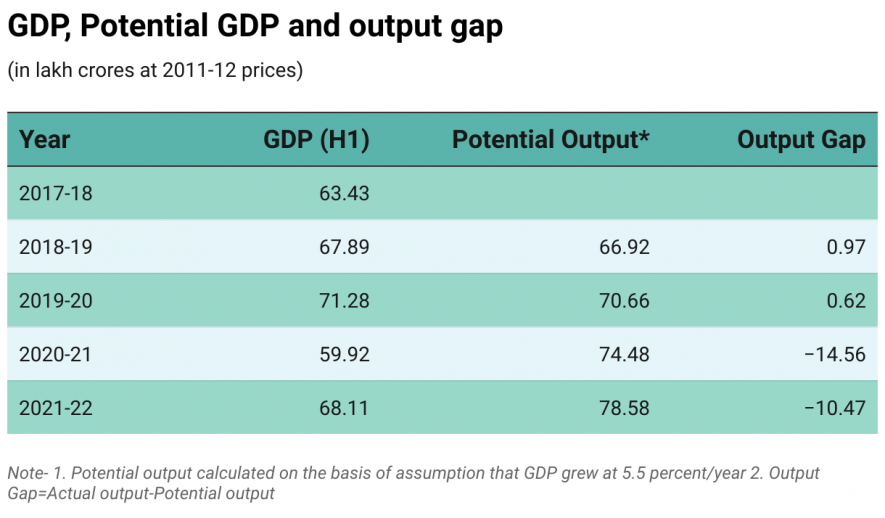

Another way to examine the claims of a recovery is to see where national output is now, compared with the trend of the economy in the years before the pandemic. The data presented in Table 1 illustrate the extent to which productive capacity has shrunk in the last few years; significantly, they predate the onset of the pandemic.

Data Source: Ministry of Statistics and Programme Implementation

One method, which is used in the comparative estimation of agricultural productivity across countries/regions, is to measure output relative to benchmark levels. This would be useful in estimating the output “gap” in India now compared to before the pandemic. Thus, by assuming a conservative annual growth rate of 5.5 per cent, it is possible to arrive at an estimate of the output gap — the shortfall in GDP, compared to the benchmark of 5.5% that is close to what the rate of growth had been before the pandemic.

The results of the exercise starkly demonstrate the extent of stagnation in the use of national productive capacity and the generation of output. The actual output in H1 2021-22 is about Rs 10 lakh crore lower than the potential output that the economy may have produced if there had been no pandemic. Over a full year, this would amount to somewhere close to Rs. 20 lakh crore. To put it more starkly, the output gap in the current year is a whopping 15%. To put it more provocatively, the level of output in H1 2021-22 is just 0.32% higher than what it was three years ago. In effect, the Indian economy has been running to stay in the same place for three years!

This sordid statistical tale does not even begin to capture the crisis that has overtaken the lives of most Indians in the past few years. Nevertheless, they expose the claims of a recovery as a cruel joke, one that defies the commonsensical reality that characterises everyday life for most Indians.

The writer is former associate editor, ‘Frontline’, and has worked for The Hindu Group for over three decades. The views are personal.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.