Record Harvest, Rising Prices, Falling Procurement

Representational Image.

The Indian people have been dogged by a rather macabre paradox in recent years, and it has forcefully struck once again this year. Production of foodgrains – cereals mostly – reaches “record” levels every passing year and yet retail prices continue upwards, government procurement languishes or even declines, and the farmers are constantly restive because they don’t get good returns.

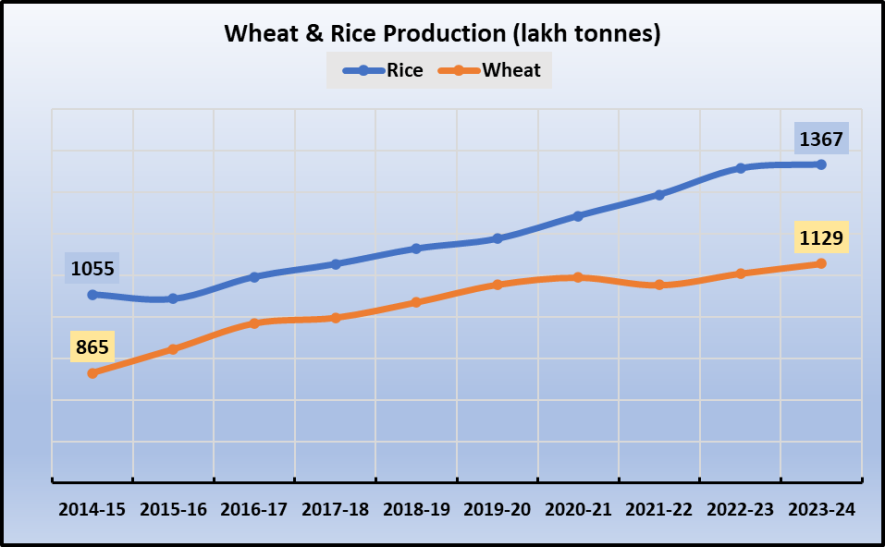

This year (2023-24), rice output reached 1,367 lakh tonnes (LT), which is a new record. Over the past decade, rice production has increased by almost 30%, which is phenomenal. Meanwhile, wheat output touched 1,129 LT this year, which is also a record high. Decadal growth in wheat production stands at about 31%. (See chart below. Data from the government’s Unified Portal for Agricultural Statistics)

It would be expected that such abundance would lead to good stocks with the government, large procurement by government agencies and its routing into the legally mandated Public Distribution System (PDS) as well as into crucial nutritional schemes like the Mid-Day Meal scheme for school children and the anganwadis run under the ICDS (Integrated Child Development Scheme).

Good procurement would also mean declared Minimum Support Price (MSP) being paid to farmers who sell to the procurement agencies like the Food Corporation of India or various state-level agencies. In short, record harvests would imply flow of food and cash to the most needy sections. Prices in open market would also be kept in check because they are usually benchmarked against the MSP. This is important because many are not covered by the PDS – numbers are estimated in crores because the present pool of subsidised grain recipients is based on Census 2011.

But sadly, all this is not happening, as we will see below.

Rising Prices

The government’s department of consumer affairs data says that retail wheat prices have risen by about 6% while the consumer price index data from the Ministry of Statistics pegs the increase at about 7%, in the past year. However, multiple media reports suggest that due to higher prices offered by traders in some wholesale markets, prices have increased by about 8%. Rice prices have risen even more – by as much as 13%, according to the department of consumer affairs data.

Pulses, a key source of protein, have shown a sharp jump in prices over the past year. Gram dal prices have increased by 17%, tur/arhar by 27%, urad by 13%, and moong by nearly 9%. Despite rising consumption of pulses over the years, India continues to depend on imports because of chaotic policy choices that determine production of pulses. In 2023-24, tur/arhar production reached 33.85 LT which is a marginal increase over the preceding year when it was 33.12 LT.

But more revealingly, arhar production had been much higher in the years before that - 43.16 LT in 2020-21 and 42.2 LT in 2021-22. Gram output had touched 135.44 LT in 2021-22 and 122.67 LT in 2022-23 but has since dipped to 115.76 LT in 2023-24. Similarly, urad production has reduced to 23 LT in 2023-24 after reaching 27.76 LT and 26.31 LT in 2021-22 and in 2022-23. Moong output too has dipped this year to 29.16 LT from 36.76 LT last year.

Low Procurement & Depleting Stocks

As of June 2024, the wheat stock in the central pool was 299.05 LT, down by 5% compared with June 2023 when it was 313.88 LT, according to the Foodgrain Bulletin published monthly by the Department of Food & Public Distribution. A few years ago, in 2021, wheat stock in June was 602.91 LT. In April 2024, wheat stock had fallen to a 16 year low of 75.02 LT barely above the stocking norm of 74.60 LT. Since then, procurement has increased the stock but, as we see below, lacklustre procurement has led to insufficient stocks. Meanwhile, rice stock in June 2024 was reported at 325.18 LT, much higher than the level in June 2023 which was 262.23 LT.

The key to the crisis lies in procurement. This year, wheat procurement target was 310 LT but as per latest reports available with the department of food and public distribution, wheat procurement stands at 260.71 LT currently, with most of the procurement over. This is roughly the same level as last year (262 LT) and higher than 2021-22 when it had dipped to just 187 LT. But prior to that, wheat procurement had reached 433 LT in 2020-21.

Why this up and down? A significant factor is the effort made by governments (mainly state agencies) to set up the mechanism for procurement. For instance, a crucial element is procurement centres – if more are set up and function effectively, then farmers will find it convenient to sell there. Otherwise, if these centres are far flung, smaller farmers with less resources will prefer to sell their wheat to traders at lower prices rather than transport their produce to the centres.

In the current procurement season, according to government data, 21,080 procurement centres were “planned” whereas only 12,197 reportedly “transacted”, that is, did any procurement. Naturally, this would lead to ineffective procurement.

According to the Foodgrain Bulletin for May 2024, Madhya Pradesh has procured only 48.38 LT wheat till end of May compared to 70.97 LT last year and 128.16 LT in 2021-22. Interestingly, the erstwhile chief minister of MP is now heading the Central agriculture ministry. Uttar Pradesh has procured 9.27 LT this year, up from 2.2 LT last year but precipitously short of 56.41 LT it procured in 2021-22.

Danger Looms Over PDS

Low procurement directly means that less foodgrain is available for distribution through the PDS. Or, the wiggle room for government to release foodgrain for open market sales and control prices is limited. Last year, the government sold 100 LT in open market from its stocks in an attempt to rein in prices of wheat. This did help somewhat. How this is going to play out this year is anybody’s guess. Industry lobbies are already demanding that wheat should be imported although the government has declared that the current 40% import duty will continue, thus preventing this possibility.

A few years ago, driven by wheat shortage in the central pool of foodgrains, the government substituted wheat in PDS with coarse grains or rice. This was not appreciated by large sections of people who complained of poor quality of bajra (pearl millet) apart from cultural preference for wheat.

But the bigger picture is worrisome: farmers are being forced to sell their produce to private traders, sometimes due to better prices, at other times due to lax procurement system. This will erode the whole government-run system with cascading effect on PDS and ultimately, on open market prices.

Whether the government in its new avatar is seized of the looming crisis or whether it sees it as an opportunity to fulfil what it couldn’t achieve with the now-repealed three agricultural laws, is anybody’s guess.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.