Only 12% Amount Realised by Creditors During December Quarter Under IBC

File Photo

The amount recovered by financial creditors in the present insolvency regime was just 12% during the quarter ending in December of the year 2019-20, lowest in at least last two years according to latest official data. As the Insolvency and Bankruptcy Code (IBC) has completed more than three years, the average time for corporate resolution is about 1.7 years, in contrast to the mandatory timeframe of 330 days for completing resolution under the code.

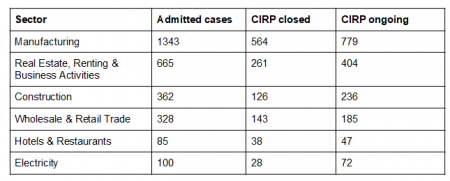

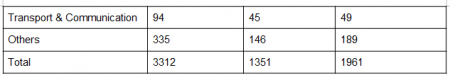

Since the IBC was enacted from December 1, 2016, 3,312 corporate insolvency resolution processes (CIRP) have commenced till the end of 2019. Of these, 246 have been closed on appeal or review or settled, 135 have been withdrawn,780 have ended in liquidation and 190 have ended in approval of resolution plans.

According to the Insolvency and Bankruptcy Board of India (IBBI), as of end of December 2019, Rs 1.58 lakh crore were realisable in cases resolved under CIRPs. This is only 43.14% against the amount claimed by the financial creditors.

Furthermore, the realisation of non-performing assets (NPAs) through IBC is staggering, reveals data. For instance, from 2017 to 2019, a total of 1,839 cases have been filed with National Company Law Tribunal (NCLT) for the recovery of NPAs worth about Rs 1.76 lakh. However, only Rs 75,745 crore has been realised which is just 43%.

Sectoral Distribution of corporate debtors under CIRP as on December 31, 2019

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.