The Mirage of an Economic Recovery

Ever the diehard optimist who promises to extract water from even stone, sarkari economists have latched on to the latest estimates of national income and Gross Domestic Product (GDP) issued by the National Statistical Office on May 31, to assert yet again that India is on the verge of an economic recovery. And, unfazed by the several false starts predicting an economic recovery since the pandemic, their cousins in the private corporate sector and the even more distant cousins in the media who have the habit of looking for cues from North Block, are humming the same tune. Nothing could be more wrong.

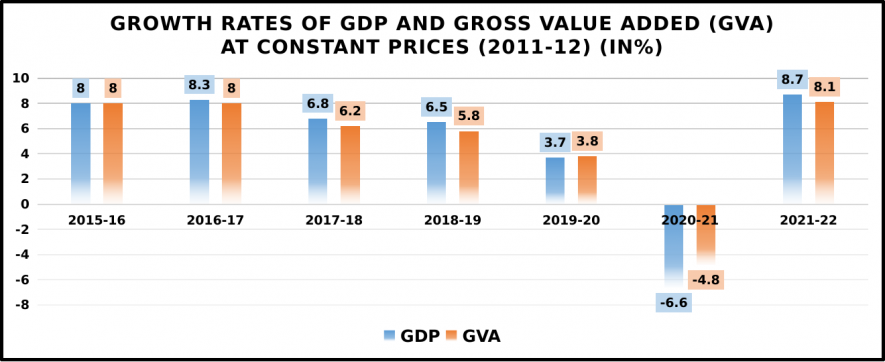

The focus of attention in the media has been on the growth rates of GDP. Attention has been riveted on the fact that in the full year of 2021-22, national GDP increased by 8.7%, by all accounts an impressive rate of growth in a world buffeted by the winds of a recession, compounded by the surge in inflation.

The other summary statistic subsumed in this data set is the fact that GDP in the last quarter (January to March 2022) increased by 4.1%. Media pundits have generally commented that the growth rate in 2021-22 is indicative of an economy recovering significantly from the pandemic. Triumphantly, they have pointed to the 4.1% growth in the last quarter of 2021-22, compared with 2.5% in the same quarter of the previous year, to argue that the economy is on the mend. As the accompanying graph demonstrates, the Indian economy has been decelerating significantly since 2018-19, from well before the pandemic.

Statistical illusions, fanciful projections

Ever since the pandemic, every now and then, mandarins in the Narendra Modi government have claimed that an economic recovery is just round the corner. In fact, the previous Chief Economic Advisor to the government famously went on to claim that the economy was on course toward a V-shaped recovery.

Lost in the breathless chatter of a recovery is a simple statistical issue. The point is that when any statistical set undergoes a period of extreme volatility — which is what characterises the world since the pandemic — percentages are dangerously misleading. The media, misled by its handlers in North Block, deliberately confuse growth rates (commonly expressed in percentages) with levels of output while making claims about a recovery.

What constitutes an economic recovery? This deceptively simple question has assumed significance in the wake of the pandemic. Simply stated, it means two things. First, that any increase or “recovery” in national economic output levels, which is what GDP measures, is anchored in a specific time in the past, before the pandemic raised its ugly head. Second, this also implies that the very idea of a recovery is made with reference to the pre-pandemic level of output.

Thus, logically speaking, the notion of a recovery is measured not simply in rates of growth in percentages but seeing how far the current national economic output is ahead or behind the level of output before the catastrophic pandemic. Yet, all the star-gazing is being made with reference to growth rates expressed in percentages, which are an affront to the basic principles of statistics.

Uneven impact of the pandemic

This is further complicated by the fact that the pandemic, like every other catastrophic event, has an unequal impact on society and economic agents. We know, for instance, that all social classes were not hit just as hard — some even became richer during the pandemic, as proved by the fantastic run of the stock markets. We also know that some sectors and economic activities fared much worse than others; the general thumb rule that can be safely employed would be to assume that the smaller the scale of economic activity, the harder the impact of the pandemic.

This unevenness in impact, and therefore the prospects of their recovery, has implications that sully the feel-good fairytale that an economic recovery is just round the corner. This is exactly the point made by those who have hypothesised that the nature of the economic recovery is not V-shaped but K-shaped, implying that the recovery or even the prospects of a recovery are extremely unevenly distributed across sectors and social classes.

For instance, the Modi government’s dogged pursuit of monetary policy, which resulted in an ultra-low interest rates, benefited large corporate conglomerates who unwound their debt positions; but smaller units are still reeling under debt burden. Not everybody is in the same boat, that is the point.

Output before and after pandemic

Now let us turn to the levels of national output to get a sense of where we are now when compared to before the pandemic. While the GDP growth rate would still mean that the Modi Government can claim bragging rights to India being among the fastest growing economies in the world, the level of output tells a different, and sobering, story.

The GDP in 2021-22 is provisionally estimated to have been Rs. 147.36 lakh crore (referenced in 2011-12 prices), compared with Rs. 135.58 lakh crore in 2020-21 — which is how we get the 8.7% growth rate of GDP in 2021-22. But, remove the reference to the previous year and instead compare this level of output to that prevailing in 2019-20, when it was Rs. 145.16 lakh crore, and you get a far more sobering picture of the state of the economy. This simple exercise shows that GDP expanded by just 1.52% over a two-year period — an annual average increase of just 0.76%.

Shocking as this may seem, there is even more. Seen in per capita terms, the picture is even more worrying. Per capita GDP, per capita Gross National Income and per capita Net National Income were all lower in 2021-22 than levels in 2019-20. In fact, per capita Private Final Consumption Expenditure, a proxy for household demand in the economy, was also lower in 2021-22 when compared to levels two years earlier. This confirms — if confirmation was indeed necessary — that demand compression is an important characteristic of the current slowdown, about which the Modi government has done little.

Two other interesting aspects of the economic performance in 2021-22 are striking. First, net taxes on products, which go into the computation of GDP, increased sharply, by 16.1%, a sharp increase compared with the previous year. In fact, Gross Value Added (GVA), the other component of GDP, increased by 8.1%, indicating that higher tax collections, possibly also feeding in through higher price levels in the economy, boosted GDP in 2021-22.

Disaggregated analysis of GVA

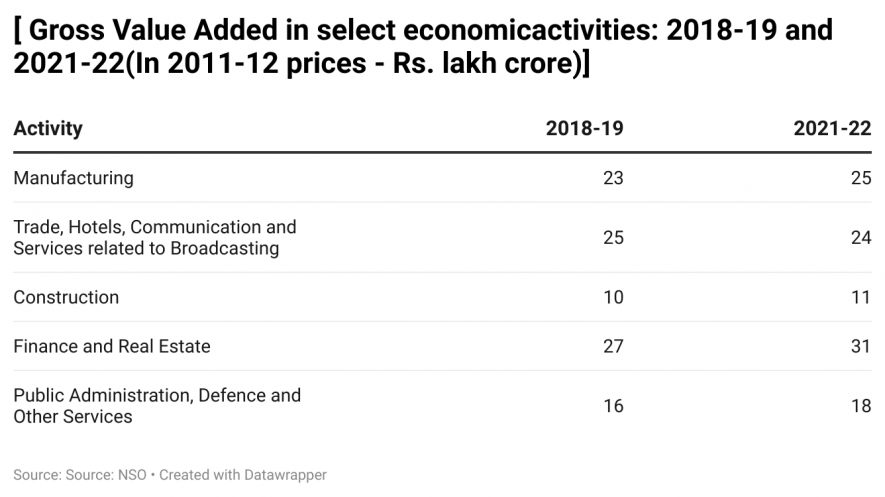

A disaggregated analysis reveals a disturbing picture, as can be seen from the accompanying table. In order to assess the claims a recovery, let us compare the GVA in 2021-22 to GVA in 2018-19, well before the pandemic and well before the sharp deceleration took effect in 2019-20.

The GVA emanating in manufacturing, which accounts for a little less than one-fifth of all GVA, increased by just 6.1% over a three-year period. This sector, which has the potential for providing linkages for employment, incomes and output, and about which the Modi regime has been talking much but doing little, thus grew at an annual average rate of just about 1.5%.

The category ‘Trade, Hotels, Communication and Services related to Broadcasting’, which is characterised by informal terms of employment and low wages but is fairly widespread, suffered a sharp collapse, particularly because of restrictions on mobility during the pandemic. The GVA emanating from this amorphous group declined by 6.03% between 2018-19 and 2021-22. Forget the recovery since the pandemic, this sector is nowhere near the output levels registered two years before the catastrophe.

The GVA in ‘Construction’, which is known to employ large numbers, especially migrant workers from across the country, increased by a measly rate of just about 1% per annum in the three-year period.

The only sharp increase in GVA has been in Finance and Real Estate and in Public Administration and Defence. The sharp increase of almost 14% in Finance and Real Estate is perhaps a reflection of the runaway boom in asset prices, real and financial, in the past few years. It also mirrors the pathetic divide in society, laying the basis for the K-shaped recovery, if you will.

Incidentally, this group of activities is now the single biggest category in terms of contribution to overall GVA. It accounts for about 23% of all GVA in the economy, implying that activity in this sector can considerably distort the overall picture of the economy’s vitality. In fact, the share of this segment of economic activity increased by two percentage points in overall GVA, indicating where the impetus to India “growth” is coming from.

Public Administration and Defence arises from purely government expenditure, which may or may not have spinoffs for the wider economy. But the sharp increase in it, rather than in other aspects of the economic sectors, probably reflects the Modi regime’s priorities.

Consumption slides, investment stalls

One other way to look at the data is to see how expenditures constituting national GDP have fared. The first, and most important one, is Gross Private Consumption Expenditure (GPFCE), an effective proxy for overall demand in the economy, and which accounts for about 55% overall GDP. In 2020-21, the value of GDP emanating from this segment fell by 6%. In the following year it increased by almost 8%.

However, the statistical illusion that percentages reflect in time volatility is in play here. The level of GPFCE in 2021-22 was not even 1.5% above the level in 2019-20 -- implying an annual increase of just about 0.7%. This is just another confirmation of the Modi government’s mindless refusal to countenance any measures that would give an impetus to demand.

More ominous signs emerge from the analysis of the contribution of Government Final Consumption Expenditure (GFCE). This component of expenditures constituting GDP, which includes the transfer payments that the government makes for social security provisions, apart from its own expenditures, played an important part in propping up the economy during the pandemic. Otherwise, things may have been more catastrophic in the aftermath of the world’s harshest lockdown. However, GFCE in 2021-22 registered a much lower increase, indicating that the Modi government is tapering off whatever little provisions for welfare that it may have initiated in the previous year.

Much has been made of the fact that Gross Fixed Capital Formation (GFCF), a measure of investment in the economy, has increased by about 15% in 2021-22. This again, is a statistical illusion: GFCF declined 10% in 2020-21 and its level in 2021-22 was just 3.75% higher than two years earlier. As economists have pointed out, this may well have been mostly for projects initiated earlier, but abandoned in the midst of the pandemic, and resumed later. It is very unlikely that that much of this would be for fresh projects, especially given the current uncertainty.

The toxic mix of inflation, rising interest rates, the depreciation of the currency and the rising levels of unemployment, not just in India but globally, make the task hazardous for economic soothsayers. Only a bhakt and his friends would dare this, but then logic was never their strong suit, was it?

The writer is former associate editor, ‘Frontline’, and has worked for The Hindu Group for over three decades.He is a member of the People’s Commission on Public Sector and Public Services.The views are personal.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.