Delay in GST Payment Forces Indebted MP Govt to Pay Over 11.7% of State GDP as Interest

Representational Image. Image Courtesy: Freepik

Bhopal: After various contradictions and confrontations, it took 17 years to draft and implement the Goods and Services Tax (GST). By signing on to the GST, states lost all power to levy indirect taxes. In return, the Union government promised to compensate them for any revenue shortfall caused by the shift to the new tax regime for the next five years with a growth rate of 14%.

Four years down the line, the GST remains a contentious issue, with the latest problem relating to compensation owed by the Centre to state governments.

The curious case of BJP-ruled Madhya Pradesh is a textbook example of how non-payment of the GST and additional financial aid by the Union government in view of COVID-19 forced the state to take heavy loans and pay over 10% of its Gross State Domestic Product (GSDP) on its repayment and interests.

In the recently presented budget on March 9, 2022, the Madhya Pradesh government admitted that implementation of GST only aggravated the state’s financial woes. “Since GST came into effect on July 1, 2017, it harshly affected the tax collection of the state. The tax losses pegged to 14 percent which would be compensated by the Union government by June 2022,” says the latest budget book.

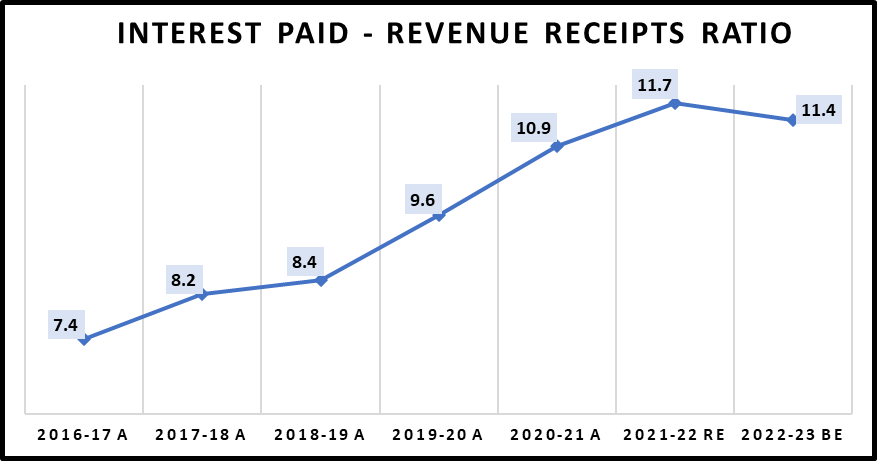

According to the budget book, in 2017-18, when the GST Act was enacted, the Madhya Pradesh government had borrowed Rs 22,430 crore from the market and spent over Rs 11,045 crore on interest and repayment of loans which was 8.2% of the GSDP. Nonetheless, in just three years, the government borrowing just doubled, and by 2021-22, the government took a loan of Rs 43,287 crore and spent over Rs 20,040 on interest which is 11.4% of the GSDP.

Speaking to reporters in a press conference after the budget inside the assembly, finance minister Jagdish Dewda said, “Over 9,500 crore is unpaid under the GST, which is likely to be paid by June 2022. It includes Rs 4,300 from the previous years.”

The state is estimated to pay Rs 22,166 crore as interest and repayment of a loan by the end of March 2023. “Between 2016-17 to 2021-22, the state has paid over 82,995 crores on just interest and repayment - on an average Rs 13,832 crore every year,” reveals the latest finance department’s gazette.

In just three years, the total debt on Madhya Pradesh surged from 1.72 lakh (21. 5% of GSDP) crore to 3.37 lakh crore (30.2% of the GSDP), the finance department gazette shows.

With such massive debt, every citizen of the state has a debt of Rs 45,634 as per the projected population of 8.55 crore by 2021, reveal data.

Speaking in the assembly over the interim budget in the winter session, former finance minister of Congress’ regime Tarun Bhanot lambasted the BJP for financial muddle who, has been in power since 2003 except the 15 months Congress rule between December 2018 to March 20, 2020.

He said, “Owing to the non-payment of the GST, Madhya Pradesh is taking massive loans and paying over Rs 20,000 crore as interest from the public account. Why would the public pay for the Union government’s economic failure, who are struggling to pay the tuition fee of their kids after the COVID-19 induced both lockdowns?

He further said, “When we used to attend the meetings of the GST council as finance minister, finance ministers of BJP-ruled states covertly give us pointers to raise it in the meeting as they fear criticizing the government of their party in the Centre. In the GST meetings, almost all the states, including BJP-ruled cry for the overdue of the GST.”

Referring to the silence of the BJP government over the non-payment of the GST, Bhanot pointed out why the Shivraj Singh Chouhan government is not strongly raising the issue of non-payment of GST before the Modi government?

“The BJP should speak to the Centre to protect the rights of over 8.5 crore people of Madhya Pradesh as we signed an agreement with the Centre in 2017. It’s our rightful right. But, the government’s silence over the non-payment of GST further aggravating the state's financial health,” he regretted speaking over the phone with NewsClick.

At the end of the speech, he proposed that a team of ruling and opposition party leaders with officials should meet with the finance minister in Delhi and demand timely payment of the GST. “No matter who is in power, the commoners can’t be put under massive debt. The government should find avenues to increase the revenue and pressure the Centre for timely payment of GST.”

Speaking to NewsClick, Jitu Patwari, a former minister in the Congress regime, pointed out, “Where is Double Engine ki sarkar? Either the Union government should pay the GST on time or admit their financial mismatch. If we had received the money on time, we could have saved crores and can spend on developmental projects.”

Not only Congress but the chairman of the 15th Finance Commission NK Singh, bureaucrat-turned-BJP leader, had also rapped the Madhya Pradesh government for financial mismatch during a meeting in Bhopal on July 5, 2019.

Seven months after the Congress returned to power on December 17, 2018, ending the 15-year-rule of the Saffron party, chairman of the 15th Finance Commission, NK Singh visited Bhopal and met with then chief minister Kamal Nath and painted a grim picture of the state.

Speaking to reporters after the meeting, NK Singh said that despite political stability and good governance, Madhya Pradesh had been ranked at 21st place in the overall performance of 29 states across the country. Showing concern over the rising poverty, he said that the poverty ratio in the state is 33% while the national average is 21% — implying that every third person in the state is poor.

Commenting over the debt, Singh had pointed out, “The government has to face a loss of Rs 4,857 crore due to cost of loan taken by it and returns of PSUS. The cost of loans taken by the government and loan advance have also put a loss of Rs 1,712 crore, said the Finance Commission report.

On March 14, during an ongoing budget session, when opposition Congress cornered chief minister Shivraj Singh Chouhan over the massive debt, he replied, “Yes, we have taken a loan and we are not the only state who is under the debt. Our debt is within our financial limits as one can only take a loan under the permissible limits of the GSDP as per the laid down laws of the finance department.”

To silence the opposition, he further said, “There are countries in the world who take 90 to 100% loan of their GDP. I want to congratulate finance minister Jagdish Dewda for presenting a profitable budget despite the COVID-19 losses. Our fiscal deficit is within limits as per the finance department. We took a loan to provide relief to all sections of society. Owing to lockdown, the revenue and taxes flow had been completely stopped, despite this, our government neither stopped procuring farm produce nor stopped any welfare scheme for the marginalised.”

Data has been collated by Pulkit Sharma

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.