A 9-Point Timeline – How Adani Dropped off Bloomberg Billionaires Index After Hindenburg Report

Image Courtesy: Facebook

The Adani Group’s market rout has spiked to a staggering $65 billion with its founder-chairman Gautam Adani slipping down from third to eighth position on the Forbes Real-time Billionaires List and dropping off the Bloomberg Billionaires Index after New York City-based research firm and short-seller Hindenburg Research published a damning report flagging “brazen stock manipulation and accounting fraud scheme over the course of decades” by the conglomerate.

The Group and the research firm are engaged in a war of words with allegations and counter-allegations flying thick and fast since the report’s publication.

Dubbing Hindenburg the “Madoffs of Manhattan”, the Adani Group termed the report as a “calculated attack on India, the independence, integrity and quality of Indian institutions, and the growth story and ambition of India”.

The research firm shot back saying that “fraud is fraud even when it’s perpetrated by one of the wealthiest individuals in the world” and accused Adani of “stoking nationalist sentiments”.

1. On January 24, Hindenburg Research publishes a two-year investigation report after speaking with dozens of individuals, including former senior executives of the Adani Group, reviewing thousands of documents and conducting diligence site visits in almost six countries.

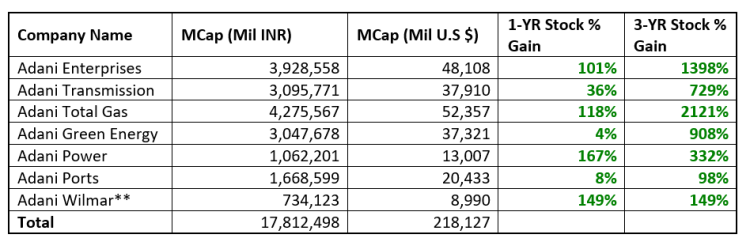

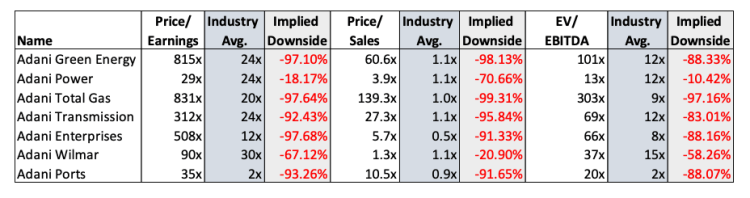

The report alleges that Gautam Adani amassed a net worth of around $120 billion, adding more than $100 billion in the past three years, “largely through stock price appreciation in the group’s seven key listed companies, which have spiked an average of 819% in that period”.

* The Group’s “seven key listed companies have 85% downside” purely on a fundamental basis owing to sky-high valuations, the report alleged.

* Key listed Adani companies “have also taken on substantial debt, including pledging shares of their inflated stock for loans, putting the entire group on precarious financial footing”. Five of seven key listed companies have reported ‘current ratios’ below 1, “indicating near-term liquidity pressure”, it said.

* Adani family members allegedly cooperated to create offshore shell entities in tax haven jurisdictions like Mauritius, the UAE, and Caribbean Islands, generating forged import/export documentation in an apparent effort to generate fake or illegitimate turnover and to siphon money from the listed companies, the report alleged.

* The report identified 38 Mauritius shell entities “controlled by Vinod Adani” or close associates. It also claimed to have identified entities that are “surreptitiously controlled by Vinod Adani” in Cyprus, the UAE, Singapore, and several Caribbean Islands.

* The research indicated that offshore shells and funds tied to the Adani Group comprise many of the largest “public” (i.e., non-promoter) holders of Adani stock.

2. On January 25, the market capitalisation of the 10 listed Adani Group stocks slumps from Rs 96,672 crore to Rs 18.23 lakh crore from Rs 19.20 lakh crore on January 24.

3. On January 27, Adani falls out of the Forbes world’s top five richest people as the shares of the Group’s companies fall sharply with Adani Enterprises down more than 18%, Adani Power 5%, Adani Ports more than 15% and Adani Total Gas, Adani Green Energy and Adani Transmission down 20%.

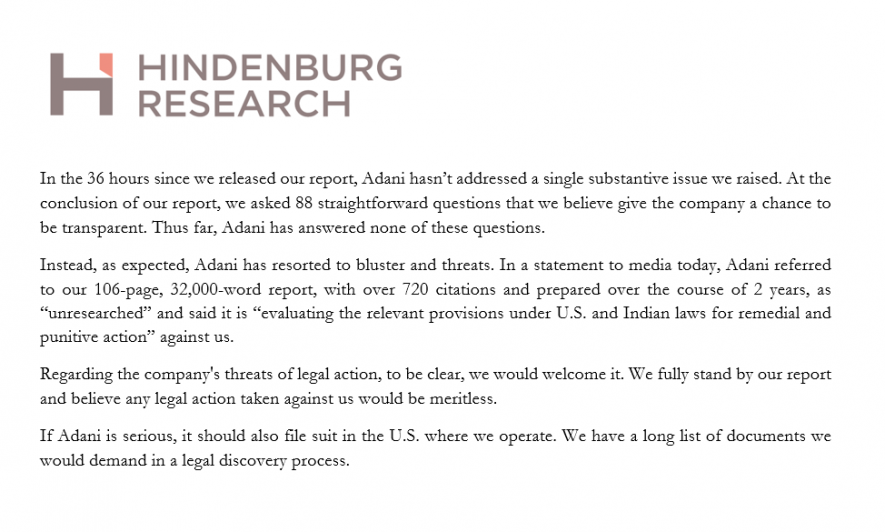

4. The Adani Group alleges that Hindenburg, “by their own admission, is positioned to benefit from a slide in Adani shares” and is considering legal action. “We are evaluating the relevant provisions under US and Indian laws for remedial and punitive action against Hindenburg Research,” the Group’s legal head Jatin Jalundhwala says.

5. On January 28, Adani Enterprises dismisses concerns over its businesses being overleveraged in response to the report. In a notice to investors in its follow-on public offer (FPO), through which it aims to raise Rs 20,000 crore, Adani Enterprises said it “categorically denied all the allegations made in the report and considers the same to be misconceived and baseless”.

6. On January 29, in a 413-page response, the Adani Group terms the Hindenburg report Research a “calculated attack” on India, its institutions and growth story and “nothing but a lie”. It alleges “an ulterior motive” behind the report to “create a false market” to allow the US firm to make financial gains. It is “a malicious combination of selective misinformation and concealed facts relating to baseless and discredited allegations to drive an ulterior motive”, it alleges.

7. On January 30, Hindenburg responds to the Adani Group’s allegations saying that “fraud is fraud even when it’s perpetrated by one of the wealthiest individuals in the world”.

Our Reply To Adani:

Fraud Cannot Be Obfuscated By Nationalism Or A Bloated Response That Ignores Every Key Allegation We Raisedhttps://t.co/ohNAX90BDf

— Hindenburg Research (@HindenburgRes) January 30, 2023

“[Adani] … predictably tried to lead the focus away from substantive issues and instead stoked a nationalist narrative claiming our report amounted to a “calculated attack on India”. In short, the Adani Group has attempted to conflate its meteoric rise and the wealth of its chairman Gautam Adani with the success of India itself.”

Disagreeing with the Group’s allegations, Hindenburg said: “We disagree. To be clear, we believe India is a vibrant democracy and an emerging superpower with an exciting future,” adding that “India’s future is being held back by the Adani Group, which has draped itself in the Indian flag while systematically looting the nation”.

Adani falls to eighth rank on Forbes rich list with Adani Total Gas, Adani Transmission and Adani Green Energy stocks dropping 20% while shares of Adani Power and food company Adani Wilmar falling 5%. Adani’s net worth falls by $8.5 billion as the market selloff in some of his listed companies continued.

8. On January 31, the tycoon falls from fourth place to 11th on the Bloomberg Billionaires Index with $34 billion of his personal wealth wiped out in only three trading days.

9. Adani’s crucial FPO achieves a full subscription as investors pump funds into his flagship Adani Enterprises despite the report.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.