Union Budget Should Focus on Improving Revenue-GDP Ratio in India

Fiscal deficit of any country, by definition, is equal to the total expenditure of the government minus the total revenue of the government. Therefore, fiscal deficit depends both on the government’s expenditure and well as revenue.

Given any cap on the fiscal deficit as percentage of GDP, government expenditure (as a proportion of GDP) can be increased only by simultaneously increasing government’s revenues (as a proportion of GDP).

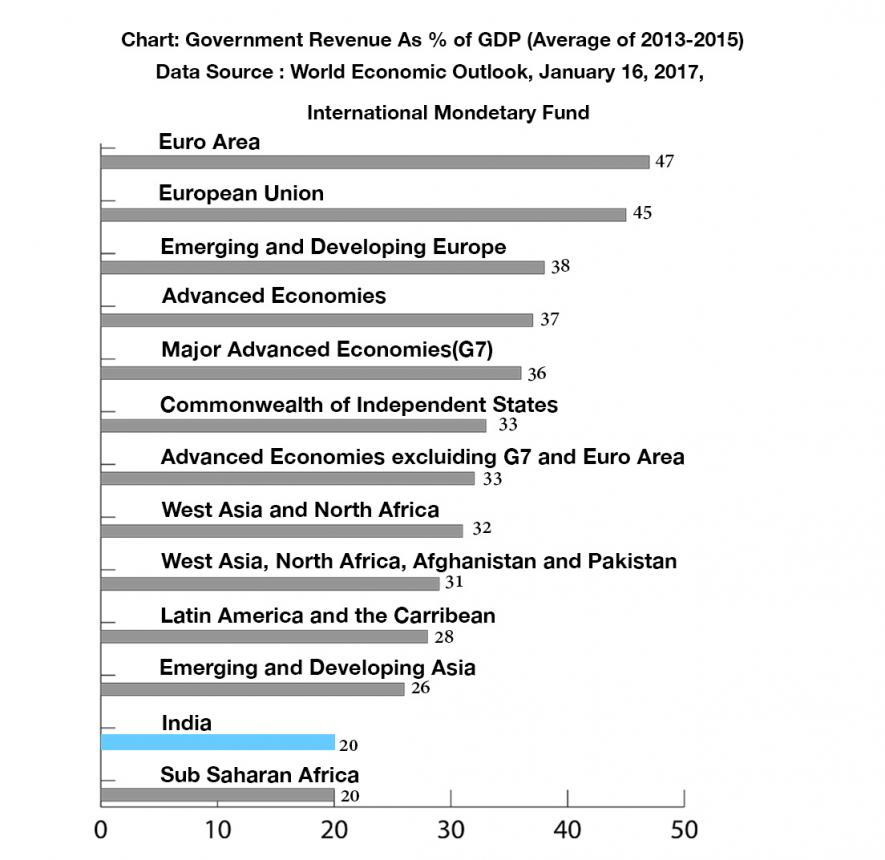

Of the total government revenue (centre and states taken together), more than 3/4th is made up of taxes and rest is non-tax revenue. Combined revenue of the central and state governments is only 20% of the country’s GDP. This is one of the lowest revenue-GDP ratio in the world (see the graph). Even though our tax rates are not really low, the tax base is relatively small.

However, the main problem is lack of tax efforts –too many tax exemptions to corporates, inefficiency of Indian tax administration and lack of tax information network. The tax raising capacity of the State governments are relatively limited in India. Hence, the union government must focus on improvement of the government revenue as a percentage of GDP, in order to make the government more relevant in India.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.