Modi’s ‘Diwali’ Gift To MSME Sector, Is Too Little Too Late

Image Courtesy: iamwire

Here's a story that is often related in Delhi’s working class areas about a worker, many years ago, who took an advance of Rs 500 from his employer for buying medicines for his sick daughter. He boarded a very crowded private bus to go home and when he put his hand in his pocket to take out the ticket money, the 500 rupees were gone. Somebody had picked his pocket. He lost his cool, cried and begged, but the money was gone. The other passengers calmed him down. But, the bus conductor demanded that he buy his ticket. The worker pleaded that he had lost all his money and should be shown some mercy. As this was going on, a passenger intervened and said, “I will buy his ticket, poor man!” and paid the fare. The broken worker thanked him and blessed him. The passenger got off the bus. He was the pickpocket!

Prime Minister Narendra Modi’s announcement of the so-called Diwali gift for micro, small and medium enterprises(MSMEs)reminds one of this story. Modi announced that loans up to Rs 1 crore will be available in 59 minutes, and a 2% interest subsidy will be given to all those who have taken loans, provided they have registered under goods and services tax (GST). He also announced that some labour law requirements will be waived for MSME units.

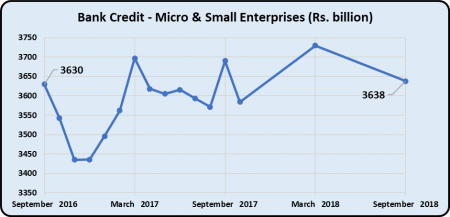

These MSME units, which are estimated to number a whopping 6.5 crore in India, were devastated by two of Modi government’s major policies – demonetisation in November 2016 and GST in July 2017. Employment and output plummeted as this double whammy dried up the largely informal sector units’ cash flows. A striking illustration of this can be seen in bank credit flow (as reported by the Reserve Bank of India) to the micro and small enterprises in these two periods in the graph below:

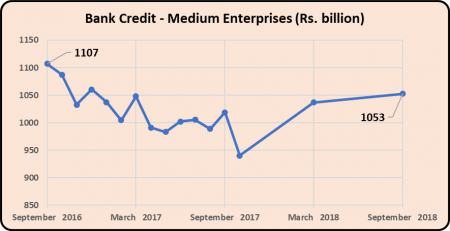

The first trough is when demonetisation took place. Then credit flow recovered somewhat but then again slumped in the GST roll-out period. A similar fate overtook the medium enterprises as shown in the graph below:

After nearly two years since demonetisation and one-and-a half-years after GST, credit flow has barely made it back to the pre-demonetisation levels. For the micro and small enterprises, total credit flow was Rs. 3,638 billion in September 2018 compared with Rs.3,630 billion in September 2016. For medium enterprises credit flow in September 2018 was Rs.1,053 billion, still lower than Rs.1,107 billion in September 2016.

This is not all. A report by SIDBI and TransUnion CIBIL revealed that in March 2018, non-performing assets or NPAs (bad loans) in the MSME sector were a staggering Rs.81,000 crore. Later, in June 2018, the RBI relaxed some provisions so that a window of 180 days was available for repayment of these bad loans. This reduced the amount by Rs.15,000 crore. But another Rs.11,000 crore was due from enterprises who were declared NPAs from at least one bank. And then a whopping Rs.120,000 crore was due from what the report classified as high-risk enterprises. The report said that by March 2019, another Rs.12,000 crore would become NPAs.

These NPAs are much lower than the those of large corporates. But bad loans are bad loans – and the existence of this malaise shows that the MSME sector is in the grip of a crisis.

Modi’s pushing of more loans to them is not going to resolve this crisis. What the MSME sector needs is demand boost that will augment output (and employment). Simply making available more loans is kicking the can down the road. You will have to pay up later.

But Modi and Finance Minister Arun Jaitley are not worried about solving the crisis. They foolishly think that such throwing of money will win them elections that are fast approaching. They want to behave like the pick-pocket who first robbed the worker of Rs.500 and then bought his bus ticket.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.