How Much Money Has Reserve Bank Put Back in the Economy?

Currency in Circulation (CIC) = Currency with the Public (CWP) + Cash Reserves of Banks

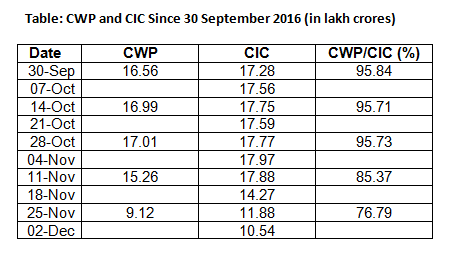

CIC data are released weekly as a component of Reserve Money while CWP figures are declared fortnightly as a component of Money Supply and with a longer lag.

1- As can be seen in the table up to the last date before the demonetization announcement for which both sets of figures are available (28 October), CWP is normally nearly 96 per cent of the CIC. Taking this, and assuming that the situation on 8 November would have been close to what it was on 4 November, the CWP on 8 November should have been around 17.0 -17.2 lakh crores. Since 86% of the currency in circulation was in the denominations of 500 and 1000 – the component of CWP in these denominations would have been around 14.7-14.8 lakh crores. The Minister for State for Finance had also announced in Parliament that the value of 500 and 1000 Rupees notes in circulation on 8 November was 15.44 lakh crores – 14.8 lakh crores would also be just under 96% of that. Thus, either way one looks at it 14.7- 14.8 lakh crores is a safe estimate of the value of old 500 and 1000 rupee notes held by the public on 8 November. Of these, according to RBI’s press release, 12.44 lakh crores worth of the invalid currency notes have already been deposited with the banks as of December 10th. Thus, only about 2.4 lakh crores, about 16 % of the original value, is still with the public with two more weeks remaining, before the period allowed for depositing the demonetised currency.

2- In the RBI’s accounting, the invalid 500 and 1000 Rupee notes are treated as part of the CIC if they are held by banks or the public (and they are mainly with the latter)– they cease to be part of the CIC only when RBI receives them. This means that the effective decline in CIC after 8 November is more than that suggested by the Table. As per the table the currency in circulation has come down every week after 4 November and up to 2 December the reduction is to the tune of 7.43 lakh crores (2 December figure – 4 November figure). This is consistent with the difference between the amount of invalid currency deposited with banks between 10 November and 10 December (12.44 lakh crores), which is a reduction in CWP and also in CIC once transferred to the RBI, and the amount of new valid currency supplied by the RBI (4.61 lakh crores) over the same period:

12.44 – 4.61 = 7.83 lakh crores

In other words, the bulk of the reduction in the CIC is a reduction in the CWP (indeed, the sharper fall in CIC is reflected in the decline in its percentage to CWP after Demonetization and till 25 November). Add to this, about 2.4 lakh crores worth of invalid notes still held by the public, the magnitude of the effective deficit in CWP compared to 8 November is still about Rs. 10 lakh crores.

This can be seen in another way. On 8 November the public had about 17.2 lakh crores (14.8 in 500/1000 notes and 2.4 lakh crores in currency of smaller denominations) of currency. On 10 December, they had 4.61 lakh crores in new currency and 2.4 lakh crores of old currency of smaller denominations – making a total of 7.01 lakh cores or about 10 lakh crores less than they had on 8 November.

3- If replacing 4.61 lakh crores of the total 14.8 lakh crores of invalidated currency took a month (from 10 November to 10 December), and that too with largely Rs. 2000 notes, how long will replacing the remaining Rs. 10 lakh cores take? The simple calculation is more than 2 months at the same rate. However, keeping in mind that there was already some stock of printed new notes on 8 November and that the number of units of lower denomination currency required to get the same value will be larger, the time required for replacing the remaining currency would be even greater.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.