Fantastic Beasts of The IL&FS Zoo

Some light is finally beginning to penetrate the bewildering dungeons of what was once India’s much applauded and super-dynamic company, IL&FS, often called the king of ‘public-private partnerships’. As reported earlier, IL&FS started sinking a couple of months ago sending tremors through the already jittery Indian financial system. Credit to non-banking finance companies, of which IL&FS was the doyen, shrank to a trickle, mutual funds saw a bloodbath in stock markets, and the brahmastra of ‘too big to fail’ was dug out for deployment. To stem the panic, a board of some of the most experienced company morticians was appointed by the Modi government to steer the company to safer waters – either full blown fire sale or a rescue with somebody somewhere coughing up an astronomical sum.

Also Read: IL&FS Crisis: It's the Rating Agencies That Really Need Some Fixing

This Board, has taken about a month to come up with a report that, for the first time reveals the byzantine maze constructed by IL&FS over two decades. The report repeatedly says that investigations are ongoing and many things might change. But here is a snapshot.

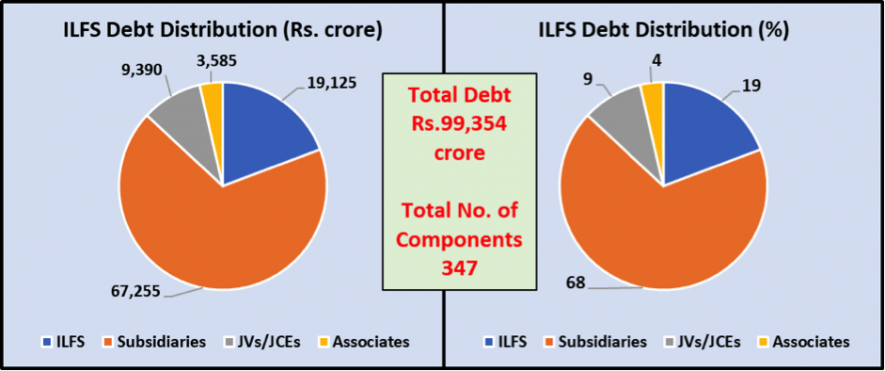

Contrary to what was reported and dissected upon earlier, there are 347 identified ‘components’ of the IL&FS menageries comprising subsidiaries, joint ventures, ‘joint control entities’ and associates. This army of corporate entities is intertwined with each other – lending to each other, buying and selling from each other, governing and being governed by each other. In flagrant violation of company law, subsidiaries have further subsidiaries down to four generations, as per current level of information.

What has been confirmed now – something that was only suspected earlier – is that 100 of the component entities are offshore – registered and located in other countries. The new Board has been able to simply identify the number and get a faint grip on a handful of these offshore companies.

“Further information in this regard is being collated and is subject to further verification,” says the Board’s report in a rather terse and pregnant fashion.

They do know that IL&FS Transportation Networks Ltd. (ITIN), the biggest Build-Operate-Transfer operator of India (remember all those pesky toll booths on highways and bridges?), owns 42 of these entities in “overseas jurisdictions such as Singapore, Spain, the US, Dubai, China and Africa”. Another major subsidiary, IL&FS Financial Services Ltd (IFIN), which is a registered NBFC in India since 2006, has in turn got four duly registered subsidiaries in United Kingdom, Hong Kong, Singapore and Dubai.

What the board needs to get its teeth into now is – how many more subsidiaries these subsidiaries themselves have and – crucially – what are their operations in known offshore tax havens? This is easier said than done but if the government is serious in its avowed objective of cleaning the stables, then the money trail needs to be followed to wherever the rainbow ends. Because it is quite within the realms of possibility now – although the Board is mum on this – that money was being siphoned off from all the frenetic project generation that IL&FS was undertaking, and stashed away in distant havens through these very foreign entities.

Also Read: IL&FS: Not Satyam, Not Lehman, Maybe it’s Both!

The debt owed by this family of fantastic beasts to external creditors is estimated by the new Board to be about Rs 99,354 crore. This includes fund-based as well as non-fund-based debt. The holding company IL&FS accounts for only 19% of this debt mountain. A jaw-dropping 68% of the debt – some Rs 67,255 crore – is owed by subsidiaries. There is more debt in the name of its JVs and JCEs etc.

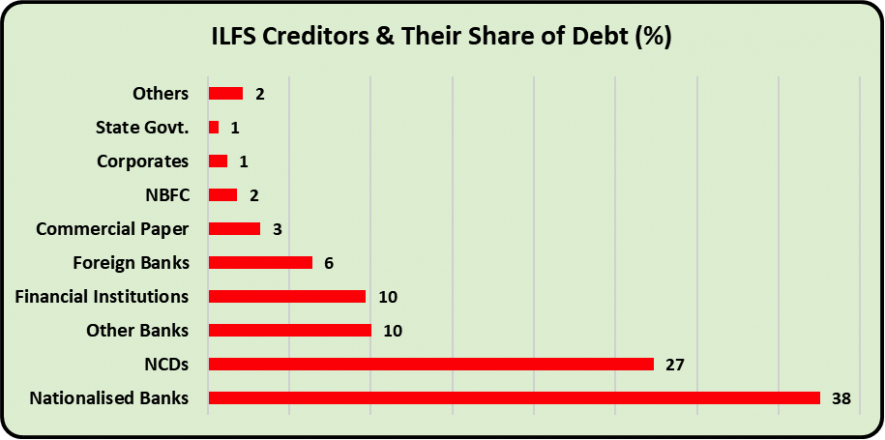

But here’s the thing: 38% of the overall debt – some Rs 35,382 crore – is owed to nationalised banks. Financial institutions are owed another 10% (Rs.9,138 crore). Broadly speaking, this is the people’s money component of the debt. Non-convertible debentures (NCDs) hold some 27% of the debt.

Besides this external debt, there is another maze that the Board is confronted with but yet to penetrate. This is the ‘internal debt’, that is, monies lent by one component to another. This is no mean amount: it amounts to a staggering Rs.31,247 crore. The report given by the Board candidly says that it still trying to figure this out.

It has also been revealed that out of the total debt of Rs.99,354 crore, a notable portion is unsecured debt. This amounts to about Rs.20,857 crore or some 22% of total debt. How this is going to be recovered is anybody’s guess.

IL&FS has already defaulted on debt amounting to Rs.4,776 crore till October 8, 2018, according to the report. That’s not very big if you look at the debt mountain confronting the company but it does raise the question as to how come all the auditors and regulatory bodies and the banks couldn’t see what was coming. Defaults loom large on the horizon much in advance of the due date. They are not bolts from the blue. Why did everybody turn a blind eye?

This strange behaviour of the oversight people is further confirmed by the admitted fact that IFIN had outstanding loans and investments to companies in the IL&FS Group of Rs. 5,728 Crore, Rs. 5,127 Crore, and Rs. 5,490 crore in FY16, FY17 and FY18, respectively. “Prima facie these appear to be significantly in excess of permissible norms, in all of the three years,” admits the Board. So why was this allowed?

Although the Board has still not addressed malfeasance – presumably the Serious Fraud Investigation Office must be delving into that aspect – but it gives some instances of the way the company was fiddling around with things.

·A certain asset of the IL&FS Group was transferred from one entity in the group to another entity in the group in June 2017 at a value of Rs. 30.8 crore for cash based on an independent fair valuation, and one year later, a committee of directors resolved to sell this to a third party for Rs. 1 crore for unexplained reasons.

·IL&FS appointed 55 of its retired employees as consultants at an annual cost of Rs. 16.5 crore.

·IL&FS Group leased properties owned by select employees (or their relatives) as guest houses of group companies. The Board gives an example of six such properties that were taken on aggregate monthly rent of Rs. 15.1 lakh with a deposit of Rs.2.26 crore.

So, what’s going to happen now? The new Board has only come up with some generic solutions that cover all bases. There is nothing on the ground yet. They suggest three options: 1) somebody puts in a whole lot of money and buys up the whole zoo; 2) Assets (read: highways and bridges and docks and so on) are sold piece by piece; and 3) compromise with creditors. These are options that everybody knew beforehand.

Also Read: Is Serial Defaulter IL&FS Heading For A Rapid-Fire Sale of Assets?

Meanwhile, trial balloons have already been floated that maybe the government should become the white knight and gallop in to rescue the company. This may mean using its Golden Goose, the LIC, for instance. That would be a sure fire way of saving the company by robbing the people, for LIC’s money is people’s money. A recent rights issue fetched a measly Rs.5.47 lakh only forcing the Board to decide to scrap the whole joke and return the money. No big player is interested.

Perhaps everybody is licking their chops and waiting for the fire sale so that they can pick up some juicy infrastructure at throwaway prices. But then, the banks (read: public money) will take a hit. Bottomline: there is no good news emanating from IL&FS and the problem is not going away.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.