Fact Check: Spin-Master Jaitley’s Claims on Demonetisation

Flying in the face of his own Prime Minister’s statements, the Reserve Bank of India’s notifications and all manner of evidence, FinanceMinister Jaitley has made the astounding claim that the demonetisation of November 8, 2016 was not about confiscation of cash but was the means to achieve ‘formalisation’ of the economy.

The RBI notification of November 8, 2016 said that the measure was “necessitated to tackle counterfeiting Indian banknotes, to effectively nullify black money hoarded in cash and curb funding of terrorism with fake notes.” Incidentally, the government notification (#2652) of that date is no longer available on the Finance Ministry website. PM Narendra Modi’s famous speech to the country is still available though (see the full video ) in which he holds forth on how this will unearth black money, curb corruption and nip terrorists in the bud.

Yet Jaitley is weaving a new fiction without batting an eyelid.

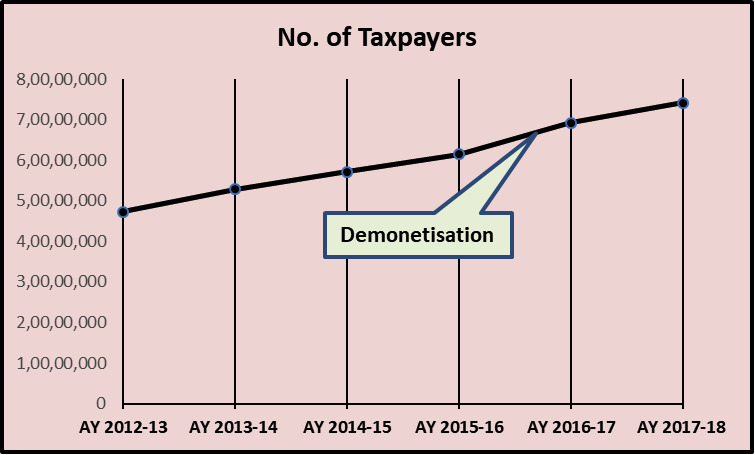

The Finance Minister says that demonetisation has led to formalisation of the economy. As an example, he says that the number oftaxpayers has increased from “3.8 crore in May 2014 to 6.86 crore in four years of the BJP-led government”. This is not a lie but a rather foolish attempt to deceive. The number of taxpayers has been increasing in any case, as shown in graph below, drawn from data put out by Central Board of Direct Taxes. It was increasing at the same rate before the Bharatiya Janata Party (BJP) government came to power. Demonetisation has done nothing to increase the numbers. Incidentally, the numbers quoted by Jaitley are inflated at the very origin because they include everybody who files a return. This included over two crore people who had no taxable income though they filed the returns. This is a phenomenon that happens every year.

Now look at another claim often made about demonetisation: that it pushed the economy towards more digital transactions. As shown in the graph below, currency in circulation was Rs.17.5 billion on October 28, 2016 according to RBI data, barely a week before the disastrous demonetisation. It was wiped out in the notebandi days and has slowly but relentlessly climbed back and stood at Rs.19.39 billion on October 12, 2018. Cash remains the dominant mode of transactions, although under coercion, it had crashed during the immediate weeks after Modi’s announcement. The only people who benefited were digital payment companies, who remain thankful to Modi for this bonanza, even if it lasted for a few months.

So, what about black money? Jaitley has conveniently forgotten about the claim repeated ad nauseum by Modi and all BJP leaders that demonetisation would lead to unearthing of thousands of crores of black money. That’s because, after taking two years to count the returned Rs.1,000 and Rs.500 withdrawn notes, the RBI had to admit finally that 99% of these had been returned to the bank. Far from unearthing black money, several thousand crores worth of black money got converted to white in the process, through diverse means, including proxy deposits.

Only a minuscle amount of fake currency was unearthed in the process. In fact, weeks after the new Rs.2,000 notes were issued, militants in Jammu & Kashmir were found in possession of fake versions.

Jaitley is unwilling – or perhaps unable – to admit that the demonetisation move was one of the biggest economic disasters India has ever experienced. It made a laughing stock of the Modi government across the world, heaped untold economic ruin and distress on a majority of Indians, and has left the country fumbling and floundering ever since.

One foolish action, and the government has had to continue telling lies for two years. Such is the nature of this government of which Arun Jaitley is a leading spin-master.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.