Tax Cut Gave Rs 61,000 Crore Bonanza to Corporate Houses

Faced with a slowing economy, Modi government’s single biggest response was to deeply cut corporate tax rates from 30% to 22%. Announced triumphantly by Finance Minister Nirmala Sitharaman on September 20 last year, this was applauded heartily by the corporate bigwigs and many economists who believe that a freer hand should be given to the “wealth creators” to go about their business.

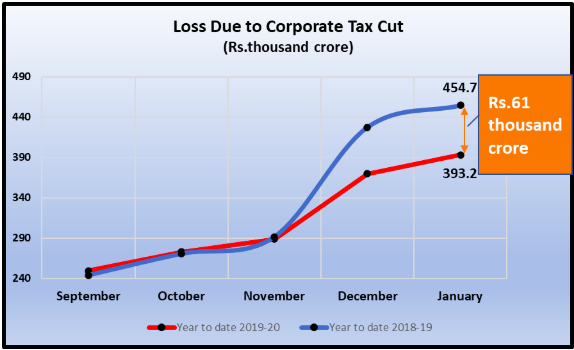

The effect of this cut is now visible. According to latest available information put out by the Controller General of Accounts (CGA), by January 2020, corporate tax collections had dropped below last year’s level by a whopping Rs. 61.44 thousand crore. In other words, industry captains had saved that much – and the government had lost as much. [See chart below]

Cumulative corporate tax collections by January 2019 were reported as Rs. 454.7 thousand crore while in January 2020, the year to date collections were Rs. 393.2 thousand crore. That’s a difference of roughly Rs. 61 thousand crore. By the time this financial year ends, this neat gift, courtesy Modi government will have ballooned to much more.

This has affected the total tax collections of the country very badly too. As per the same CGA report, gross tax revenue in January 2020 was Rs. 15.3 lakh crore compared to Rs. 15.6 lakh crore in January last year. That’s a gap of over Rs. 31 thousand crore. This would have been wiped out if corporate tax had not been cut. Other tax sources that have suffered are customs and excise duties.

Also read: Modi Govt Gives Rs.1.45 Lakh Crore Gift to Corporates

In fact, the situation is worse because the government had set a higher target for tax collection this year compared to last year. Yet, things are going in the opposite direction.

Has It Revived Economy?

What this tragic situation brings out vividly is this: Modi government is miserably failing to bring the economy back on track. In fact, it is only using the crisis of slowdown to push through more concessions and gifts to the private sector, especially the big corporate strata, both domestic and foreign.

The logic behind cutting corporate taxes was ostensibly that it would help struggling corporates, give them some cash in hand to invest in more productive capacities, and thus, improve employment and generally give a fillip to demand. The dream was that this tax cut would send ripples of happiness and prosperity across the country, and from top to bottom.

This house of cards has collapsed within a few months, as was predicted by many and as has been the experience in many other countries.

This approach also reveals a completely cock-eyed view of how the economy runs. Because, the problem is not that corporates need money in their hands – it is the people who need it! If people had sufficient buying power in their hands, they would create a demand that would send ripples across the economy, boosting demand all through. That, in turn, would cause industry to expand productive capacities, thus increasing employment. The government could also help by increasing its own expenditure.

But the Modi government has gone about it in the opposite way, pushing the country towards a disastrous course. It has become more tight-fisted in its spending, given more concessions to corporates, invited more foreign investors, tried to sell off more of public sector assets and is moving to destroy protective laws for labour. All to help corporates, who are simply enjoying healthier profits, without ploughing anything back in the economy for expanding production or employment.

Meanwhile, people are suffering immensely because of these policies. Unemployment continues at around 8% – it has been ranging between 7% and 8% for the past year, causing untold misery. Families’ consumption spending has dipped. Inflation in food items has aggravated this. Jobs have been lost in lakhs. Wages are either stagnating or reduced. And, declining tax revenues have led to cuts in welfare measures at a time when they were most sorely needed.

Also watch: Tax Benefits for Corporates But What About People?

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.